Most small nonprofits don’t give much thought to how their Chart of Accounts (CoA) connects to the IRS Form 990-EZ — until tax time hits. Then, suddenly, all those vague categories like “Supplies,” “Miscellaneous,” and “General Expense” make preparing the return feel like solving a puzzle with missing pieces.

A little structure early on can make a big difference later. Aligning your CoA with the 990-EZ doesn’t mean you need a giant overhaul — it just means setting things up, so your books tell the same story your 990-EZ will. The payoff is cleaner reports, easier audits, and less scrambling when it’s time to file.

>>> Next, let’s walk through how the 990-EZ is organized — and which parts actually connect to your bookkeeping.

Understanding the 990-EZ

The Form 990 series keeps nonprofits transparent about where their money comes from, how it’s used, and who’s leading the organization. Which version your nonprofit files depends on its annual gross receipts and total assets:

- Form 990-N (e-Postcard): for very small organizations with $50,000 or less in annual gross receipts. It’s a simple online filing with no detailed reporting.

- Form 990-EZ: for organizations with less than $200,000 in annual receipts (donations + program fees) and less than $500,000 in assets (cash, property, equipment, etc.).

- Form 990: the long form, required once those thresholds are exceeded.

Most small nonprofits fall into the middle category — the 990-EZ — which is what this article focuses on. It’s detailed enough to show accountability but short enough to complete without needing a full accounting department.

What the 990-EZ Includes

Here’s how the form is organized and how each part connects back to your bookkeeping system:

| Part | What It Covers | Connection to Your Books |

|---|---|---|

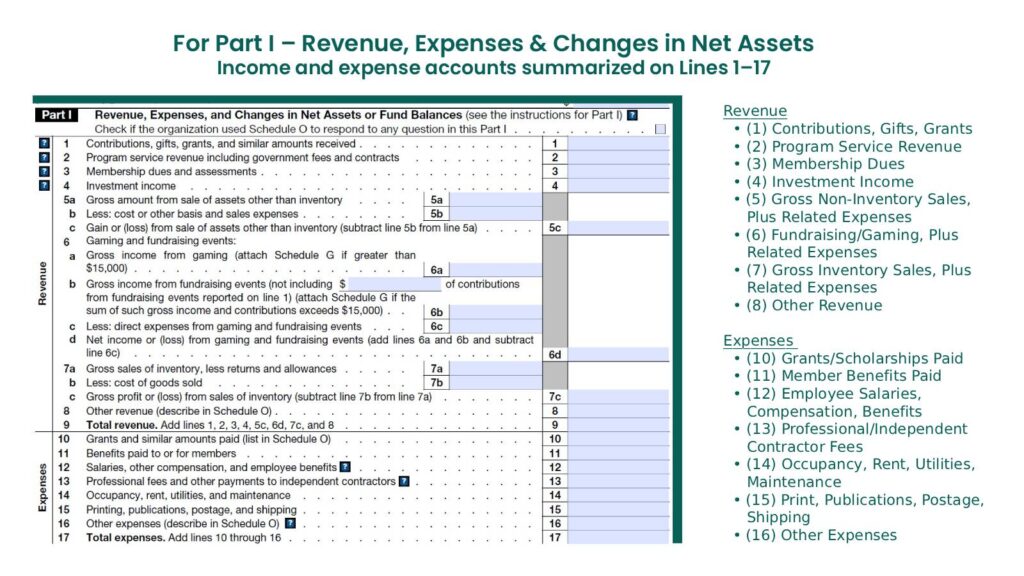

| Part I – Revenue, Expenses, and Changes in Net Assets or Fund Balances | Combines your income and expenses on one page — contributions, program service revenue, fundraising events, and other income — then subtracts expenses to show net change. | These figures roll up directly from your Income and Expense accounts. |

| Part II – Balance Sheets | Lists assets, liabilities, and net assets at the beginning and end of the year. | Drawn from your Balance Sheet accounts: cash, savings, receivables, property, and debts. |

| Part III – Statement of Program Service Accomplishments | Describes your organization’s key programs and what they achieved. | Clear program names in your Chart of Accounts make it easy to pull the right expenses and write concise descriptions. |

| Part IV – List of Officers, Directors, Trustees, and Key Employees | Reports the names, titles, and compensation of your organization’s leadership. | Pulls directly from your Payroll accounts — wages, taxes, and benefits. |

| Parts V and VI – Other Information and Signatures | Ask about loans to officers, political activity, and other compliance details. | These usually don’t apply to small 501(c)(3)s, so they aren’t covered in this article. |

Why Focus on the 990-EZ

For most tiny and small nonprofits, the 990-EZ hits the sweet spot — it still shows accountability but keeps the financial detail at a manageable level. Aligning your Chart of Accounts with this form means your reports naturally match what the IRS is asking for, without overcomplicating your bookkeeping.

>>>Next, let’s walk through how to structure your Chart of Accounts so your reports naturally align with the 990-EZ.

Organizing Your Chart of Accounts Around the 990-EZ

The goal isn’t to mirror the 990-EZ line-for-line — it’s to build a Chart of Accounts that naturally rolls up into those key sections. When your CoA follows the same logic as the 990-EZ, your reports practically organize themselves.

We’ll start with Part I of the Form 990-EZ, where income and expenses come together, then take a closer look at Part IV (Compensation) and Part III (Program Expenses)—both of which make up key portions of that same expense section. From there, we’ll wrap up with Part II (the Balance Sheet) to show how your assets and liabilities tie everything together.

I will provide aFor each section, I’ll include a sample of how I would set up the Chart of Accounts. Every nonprofit’s structure looks a little different, but the examples I share reflect a setup that’s simple, clear, and aligned with how the Form 990-EZ reports activity.

Part I – Revenue, Expenses & Changes in Net Assets

Part I of the 990-EZ combines your organization’s income and expenses on one page (see image below). Everything you’ve earned or received — from donations to program fees — appears alongside everything you’ve spent to run programs, manage operations, or raise funds.

This is where a well-structured Chart of Accounts really pays off. When your income and expense categories mirror the layout of this section, the totals you see in QuickBooks flow naturally into the lines on your 990-EZ. No guesswork, no last-minute scrambling.

COA Setup Example

Contributions

- Contributions –

- Unrestricted

- Individual Donations

- Corporate Donations

- Restricted

- Building Fund

- Scholarship Fund

- Grants*

- Local Foundation Grant

- State Grant – Youth Program

- Unrestricted

- Program Service Revenue

- Membership Dues

- Tuition

- Fundraising Income

- Event Ticket Sales

- Silent Auction Proceeds

- Interest/Investment Income

Expenses

- Management/Admin Expenses

- Office Supplies

- Software Subscriptions

- Marketing

- Office Expenses

- Rent

- Utilities

- Maintenance

- Professional /Independent Contractor Fees

- General Fundraising Expenses

- Event Supplies

- Donor Mailings

*Note: Grants are technically contributions, but they’re often tracked as sub-accounts under Restricted Contributions to separate structured funding (like foundation or government awards) from general donor gifts. The IRS reports them all together under “Contributions, Gifts, and Grants” on the 990, so this setup keeps your books practical and aligned

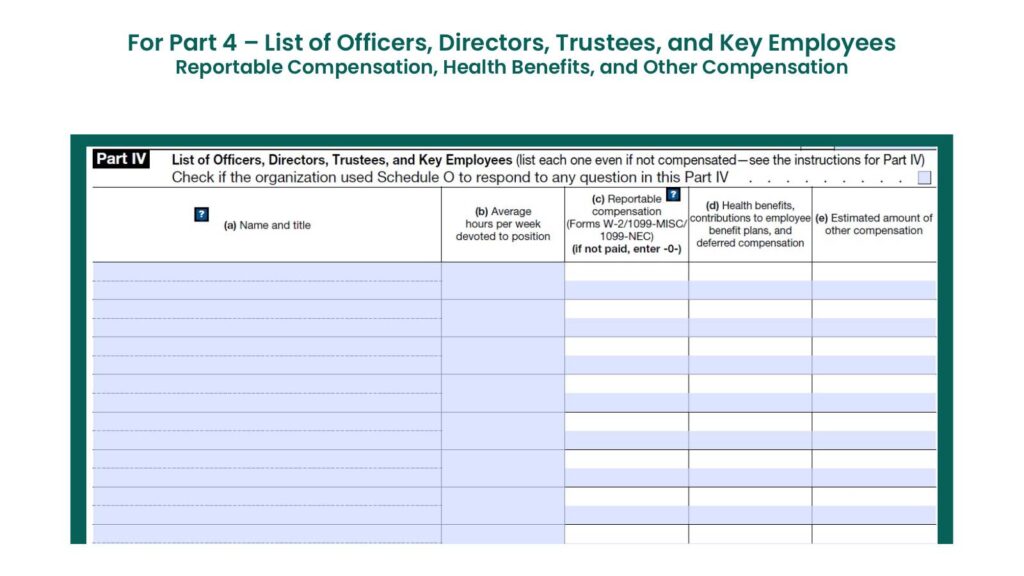

Part IV – List of Officer, Directors, Trustees, and Key Employees

Wages, taxes, and benefits might not be glamorous, but they’re often a nonprofit’s largest line items. If you’re using a payroll service like QuickBooks Payroll, Gusto, or OnPay, you don’t need to break out wages by individual employee in your Chart of Accounts. Those systems can generate reports showing total salary, benefits, and other compensation for each person whenever you need it. What matters is keeping your payroll categories—wages, taxes, and benefits—organized in their own section of your Chart of Accounts so you can easily tie totals to Part IV of the 990-EZ and your overall expense reporting.

(See the image below for how these payroll categories connect to your 990-EZ reporting.)

CoA Setup Example

Expenses

- Management/Admin Expenses

- Office Supplies

- Software Subscriptions

- Marketing

- Office Expenses

- Rent

- Utilities

- Maintenance

- Professional /Independent Contractor Fees

- General Fundraising Expenses

- Event Supplies

- Donor Mailings

- Payroll

- Wages

- Taxes

- Benefits

- Other Compensation

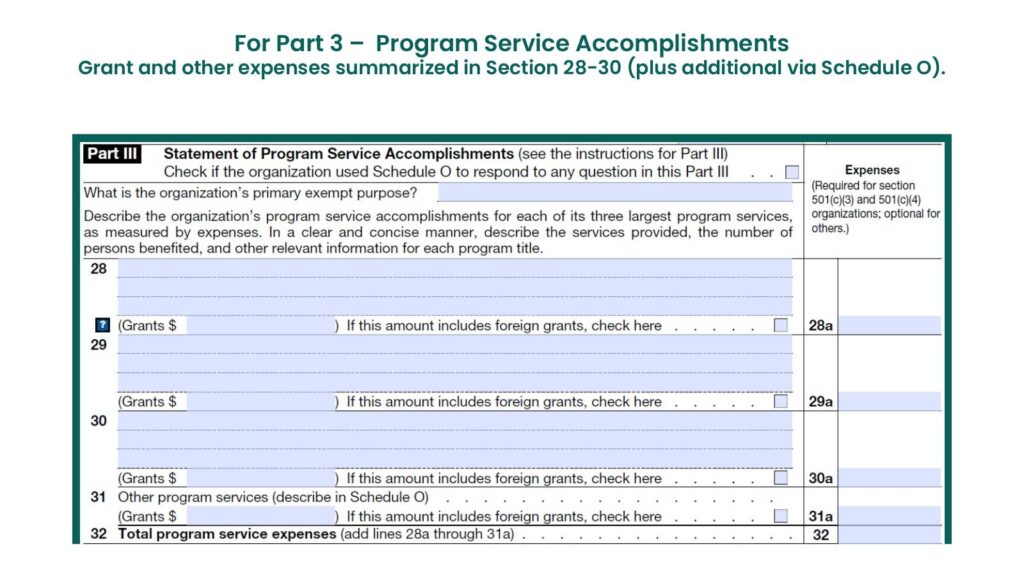

Part III – Statement of Program Service Accomplishments

Part III shifts from dollars to impact — it’s where your organization tells the IRS (and the public) what your main programs are and what they achieved. While it’s mostly a narrative section, your bookkeeping plays a key supporting role here.

When your Chart of Accounts mirrors your programs — for example, Youth Tutoring Supplies or Community Meals Contract Services — it’s easy to pull accurate totals and write clear, credible descriptions. The numbers from your expense accounts back up the story you tell in this section, giving your 990-EZ a consistent thread from financials to mission.

(See the image below for how your Chart of Accounts connects to your program narratives.)

CoA Setup Example

Expenses

- Management/Admin Expenses

- Office Supplies

- Software Subscriptions

- Marketing

- Office Expenses

- Rent

- Utilities

- Maintenance

- Professional /Independent Contractor Fees

- General Fundraising Expenses

- Event Supplies

- Donor Mailings

- Payroll

- Wages

- Taxes

- Benefits

- Other Compensation

- Program A

- Fundraising Expense

- Scholarships Paid

- Tutoring

- Program B

- Fundraising Expenses

- Food Purchases

- Space Rental

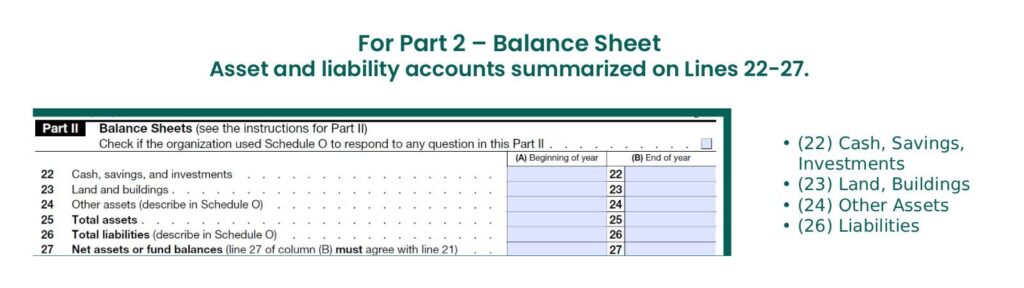

Part II – Balance Sheet

Part II of the 990-EZ gives a snapshot of what your organization owns, owes, and retains at year-end. It’s essentially your Statement of Financial Position — a simple two-column comparison showing beginning-of-year and end-of-year balances for assets, liabilities, and net assets (fund balance).

When your Chart of Accounts groups these items clearly — separating operating cash from savings, short-term from long-term liabilities, and restricted from unrestricted net assets — it becomes easy to complete this section accurately. A well-organized Balance Sheet doesn’t just help with the 990-EZ; it also shows your board and donors the financial stability of your organization at a glance.

(See the image below for how your asset and liability accounts connect to Part II of the 990-EZ.)

CoA Setup Example

Assets

- Checking – Operating

- Savings – Emergency Fund

- Investments – Fidelity EFTs

- Prepaid Expenses

- Building

- Equipment

Liabilities

- Credit Card – AmEx

- Loan – Community Bank

- Deferred Revenue – Summer Program

>>> Next, we’ll look at how to keep your Chart of Accounts aligned over time — with consistent naming, smart review habits, and a little restraint when adding new accounts.

Maintaining Consistency and Simplicity

Setting up your Chart of Accounts is only half the battle — keeping it clean is what saves you later. Over time, it’s easy for new accounts, duplicates, or “temporary” fixes to sneak in. Before you know it, your reports look more like a scavenger hunt than a financial summary. The key is to make your CoA work for you, not against you.

1. Keep Names Consistent

Decide early how you’ll name things — and stick with it. My thought: simple naming + subaccounts = cleaner reports and easier 990-EZ prep.

Before:

- Program Supplies – Summer Camp

- Program Supplies – Youth Program

- Program Supplies – Tutoring

After:

- Program Supplies

- Summer Camp

- Youth Program

- Tutoring

2. Review and Trim Regularly

Once or twice a year, review your Chart of Accounts. Merge duplicates, archive unused accounts, and make sure new ones truly belong. If an account hasn’t had activity in 12 months, ask yourself why it’s still there.

3. Don’t Overcomplicate Subaccounts

Subaccounts are great — until they’re not. If you have to scroll to see the full list, it’s probably too long. Group only what helps with reporting and decision-making.

4. Schedule a Quick Monthly Check

Each month, glance through your accounts for any odd new additions or misclassifications. Fixing a few small issues now beats digging through “Miscellaneous Expense” six months from now.

5. Document Your Structure

If you’re not the only one handling the books, or you eventually hand them off, keep a short “Chart of Accounts Guide”. Just one or two pages listing your naming rules and account purposes can save hours of confusion later.

Clean books make for smoother reporting, clearer board communication, and less panic at tax time. Your CoA doesn’t need to be perfect — it just needs to be logical, consistent, and maintained.

>>> Next, we’ll wrap up with a few closing thoughts on creating alignment between your books and your mission.

Bringing It All Together

A well-structured Chart of Accounts isn’t about perfection — it’s about clarity. When your CoA mirrors the 990-EZ, your reports naturally fall into place. You’ll spend less time reclassifying or guessing, and more time understanding your numbers. The goal is simple:

- organized enough for the 990-EZ,

- practical enough for the board, and

- straightforward enough that no one dreads opening QuickBooks.

If your setup reflects your real-world operations — admin, fundraising, payroll, and programs — you’re already ahead of most. And remember, this isn’t a one-time task. Review it once or twice a year, make small refinements, and let your CoA evolve with your organization. That steady attention pays off every time you need to report, plan, or explain where the money went. Because in the end, clean books don’t just make filing easier — they help your nonprofit tell a clearer financial story that supports the mission you’re working so hard to deliver.

Need a Little Help?

If your Chart of Accounts could use a second set of eyes —or you’d like to make sure your books align with your next 990-EZ — I can help. Whether it’s a one-time review or a full setup, my goal is simple: make your financials make sense so you can stay focused on your mission.

That’s the kind of clarity that saves time, reduces stress, and keeps your nonprofit ready for whatever’s next.